"Building a Climate Resilient Future" launched at COP28. This report is in collaboration and a joint initiative between the United Nations Climate Change High-Level Champions, the United Nations Race to Resilience, the Adrienne Arsht-Rockefeller Foundation Resilience Center, and Marsh McLennan. It is prepared with the research, writing, and the support of Oliver Wyman.

Over the past 50 years, the number of weather-related disasters has risen five-fold, with climate change generally accepted to be a primary driver. Climate-related risks continue to grow and threaten global business and communities.

The increasing frequency and severity of extreme-weather events is compounded by population growth and economic development in high-risk areas due to urbanization — placing more people in harm’s way and resulting in a significant increase in losses.

Investing in adaptation and resilience is critical to combat these rising costs and ensure that communities around the world can better withstand and recover from disaster. The insurance industry is uniquely positioned to support and reward investments in adaptation and resilience. Transferring risk through insurance coverage provides households, businesses, and communities with the funding they need to recover rapidly from disasters. Additionally, insurers have the data and risk expertise to encourage risk-reducing activities, enable more resilient communities, and directly invest in resilience.

By playing a larger role in increasing resilience, insurers have the power to reduce overall weather-related losses, protect their existing markets, and expand coverage into new markets — the combination of which presents a $71 billion annual revenue opportunity for the insurance industry.

Our new report, “Building A Climate-Resilient Future”, launched at COP28 and is in collaboration with the United Nations’ Race to Resilience initiative and the Adrienne Arsht Rockefeller Foundation. We share five recommendations on how the insurance industry can better adapt to climate change, address barriers, scale impact, seize commercial opportunities and build climate resilience.

The recommendations outline opportunities for insurers to contribute to reduced weather-related losses, expand insurance coverage, and ultimately improve economic outcomes. The report draws upon research and perspectives from experts across Marsh McLennan as well as the broader insurance industry. It also builds on last year’s report, “Fulfilling A Legacy Of Societal Risk Management,” which was released at COP27.

The adaptation and climate resilience gap

The intensification of heat waves, floods, droughts, wildfires, storms, and other climate-related hazards has far-reaching implications on communities and ecosystems globally. The average global surface temperature has increased to 1.1 degrees Celsius above pre-industrial levels and the consequences are readily apparent for the increased frequency and intensity of natural disasters. The United Nations’ Intergovernmental Panel on Climate Change has said the most likely scenario is for an increase of around 2.7 degrees Celsius by the end of the century.

The unique role of the insurance industry

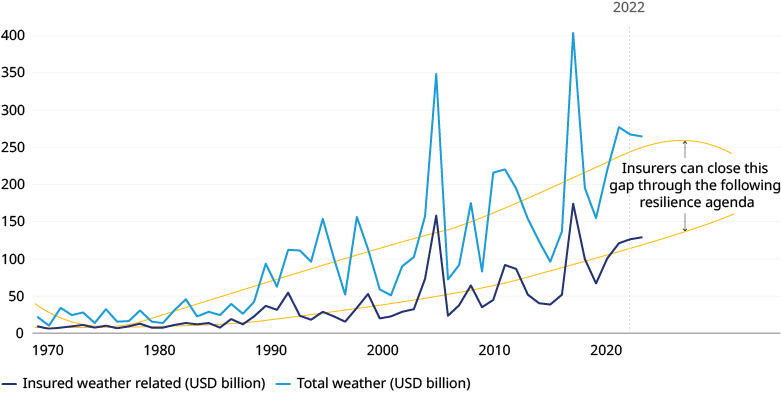

Supporting adaptation and resilience in the face of climate change is not just an opportunity, but a commercial imperative for the insurance industry. Currently, only 43% of global weather-related losses are insured, equating to a $132 billion protection gap (exhibit 1). While this gap exists for a multitude of structural and socioeconomic reasons that cannot be solved by the insurance industry alone, insurers can pursue strategies that may help narrow the gap.

Exhibit 1: Insured versus total weather-related losses

Source: Oliver Wyman analysis based on Swiss Re Institute’s Sigma Explorer; assumed 60% loss ratio

Investment in adaptation and resilience is needed

Climate change may drive weather-related risks in certain regions to levels that are no longer insurable, eroding markets and shrinking profit pools. However, investing in adaptation and resilience can do more than protect existing markets. It can unlock new ones by improving the insurability of underserved communities and creating new business opportunities. By building resilience insurers can increase the proportion of losses covered when disaster strikes. Our report examines how to do this more effectively.

We estimate that by pursuing this UN Race to Resilience agenda, the insurance industry can close up to 30% of the existing protection gap, presenting a $71 billion annual revenue opportunity for insurers while contributing to the resilience of millions of people.

Current state of resilience as a strategic imperative

Despite the insurance industry’s significant exposure to climate impacts and its unique position to benefit from increased climate resilience, the integration of adaptation and resilience into firm-wide strategy remains largely overlooked by most insurers and reinsurers, particularly when compared with the incorporation of emissions reduction and energy transition goals (exhibit 2).

Exhibit 2: Climate-related targets and initiatives discussed in sustainability disclosures

While 80% of climate-related financial disclosures mention adaptation and resilience, this acknowledgment is often focused on philanthropy or broad, conceptual statements. Beyond philanthropy, only 10% of disclosures identify quantifiable adaptation and resilience targets. Within this 10%, targets are not necessarily comprehensive. They’re also focused on short-term time horizons and lack the same level of robustness as corresponding carbon emissions and transition targets.

In a separate review of publicly available materiality assessments from the same sample of global insurers (exhibit 3), 88% of reports identified climate-related issues as a significant material risk in some capacity. However, only 35% specifically identified climate adaptation and resilience as a top-priority material outcome. By defining an explicit strategy around resilience, insurers can target areas of their portfolio that are most at risk, and design products and broader initiatives to address supply and demand barriers.

Exhibit 3: Priority climate-related materiality issues identified in organizations’ materiality assessments

Barriers insurers need to overcome to scale their adaptation and resilience impact

To play a more widespread role in adaptation and resilience, the insurance industry needs to overcome barriers and a variety of internal and external challenges. This includes demand-side constraints (lack awareness of climate-related risks and the benefits of insurance), supply-side constraints (data and modeling that does not fully inform and support quantification and pricing of climate-related risks), and regulatory and policy constraints (governments often favor investment in disaster relief over disaster prevention). Our report provides recommendations on how insurers can address these barriers to accelerate and scale their impact. Below is an excerpt of our recommendations.

Five recommendations for insurers to build climate resilience and seize opportunity

Insurers should determine how these recommendations can be leveraged to best suit their priorities and goals, taking into consideration their key geographies, risk exposure, size, and capabilities. For each of our recommendations to be successful and unlock significant benefits, the insurance industry will need to undergo something of a mindset shift and expand its existing “toolbox” beyond traditional risk transfer to embrace a range of solutions and services designed to build resilience and enhance adaptation. Our five-point resilience agenda allows the insurance industry to support increased climate resilience and benefit from commercial opportunities, through expansion of coverage as well as reduction in overall losses.

Prioritize resilience as a strategic imperative

Current insurer climate strategies focus largely on lowering carbon emissions, but not improving adaptation and resilience. By prioritizing resilience in their near-term plans and defining an explicit resilience strategy, insurers can greatly improve the long-term viability of their business models. This requires a deliberate commitment to actively pursue and maximize opportunities to expand business and incentivize resilience, and the design of products and broader initiatives to target areas of the portfolio that are most at risk.

Collaborate with the public sector to expand coverage

Evidence shows that public-private partnerships can deliver higher levels of insurance penetration among the general population than private markets alone. Designed well, these partnerships can provide insurers with access to underserved communities and protect existing markets from climate-driven premium inflation. Public-private partnerships are likely to become an increasingly important part of the insurance toolkit as the severity and frequency of weather-related disasters continues to rise, increasing overall weather-related risks and the cost of coverage.

Improve accuracy and availability of climate-related data and analytics

Access to high-quality and forward-looking data and analytics is crucial for insurers, as it directly impacts their ability to accurately price risks and provide coverage to individuals, communities, and commercial enterprises. By improving data and analytics, insurers can better incentivize resilience as well as expand coverage to underserved populations.

Create an industry standard around build back better

The concept of build back better enables communities to better manage future disaster risks by improving the construction process — through ensuring new development is located outside of high-risk areas and requiring that buildings and infrastructure can structurally endure disasters. Data has shown that stronger buildings and infrastructure significantly reduce financial losses and costs from natural disasters. Insurers have the opportunity to play a larger role in build back better initiatives by facilitating and incentivizing both post-disaster as well as pre-disaster structural improvements.

Advocate for public policies and regulations that support resilience

Given risk data is a core part of the insurance business model, insurers are well positioned to influence, advocate for and support risk-based planning and decision-making. For insurers, this means getting involved much earlier and to a greater degree in planning with the public sector to enable decision makers to make and facilitate better building and land-use decisions. Examples of specific changes that insurers can influence include encouraging the establishment and wider application of more resilient building codes, discouraging development in high-risk areas, and advocating for greater public investment in nature-based solutions and protective infrastructure such as flood defenses.

Roadmap for adaptation and climate resilience success

Investing in climate adaptation and resilience in the insurance industry is already well underway. Our report highlights a number of ongoing successful initiatives and case studies to learn from and expand upon. These initiatives encompass key themes from our recommendations such as strategic partnerships, collaboration and knowledge sharing, data and analytics, policy advocacy, product innovation, and financing and investments. These themes reflect the diverse strategies and approaches being employed to comprehensively address climate adaptation and resilience.

Defining and sharing metrics will further encourage the insurance industry to focus their efforts on resilience opportunities. It will be critical for global leaders to provide guidance on metrics that can track the insurance industry's progress, highlight potential challenges and measure success.

Ultimately, though, enabling widespread impact on resilience will require a greater effort than that of a single firm or organization. It is essential for the industry and its stakeholders to engage in widespread collaboration and take collective action to increase resilience globally.

%20copy.jpg.imgix.fourColumnTile.jpg)