The healthcare industry has seen major shifts over the last decade, including significant health reform with the passing of the Affordable Care Act, retail giant Amazon entering the industry, and the boom of telehealth as a new front door to care. Below, our experts share their perspectives on what healthcare might look like in the decade ahead. We analyze the transforming pharmacy market, economic scenarios the health industry will face, and what might happen in the booming Asia market.

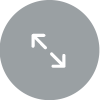

Pharmacy 2030: 5 Bold Predictions

Over the next decade, pharmacy is ripe to change significantly, fueled in large part by the trajectory of pharmacy spend and the nature of drugs coming to market. An increase in specialty drug approvals is breaking the cost curve. In fact, 2019 was the first year that specialty costs surpassed that of traditional drugs. By 2030, overall pharmacy spend will exceed $1 trillion. This phenomenon is fundamentally changing “pyramid math”, as three percent of consumers astonishingly drive 70 percent of pharmacy spend in the commercial funding segment. This begs for new pharmacy management models. Moreover, new drugs are emerging with very different profiles – these now curative solutions, personalized medicines, alternative solutions, and digital therapies carry incredible promise, but also fundamentally different economics and management challenges. Below are five predictions for pharmacy, learn more via our article link below.

Infographic: Healthcare 2030 Survey

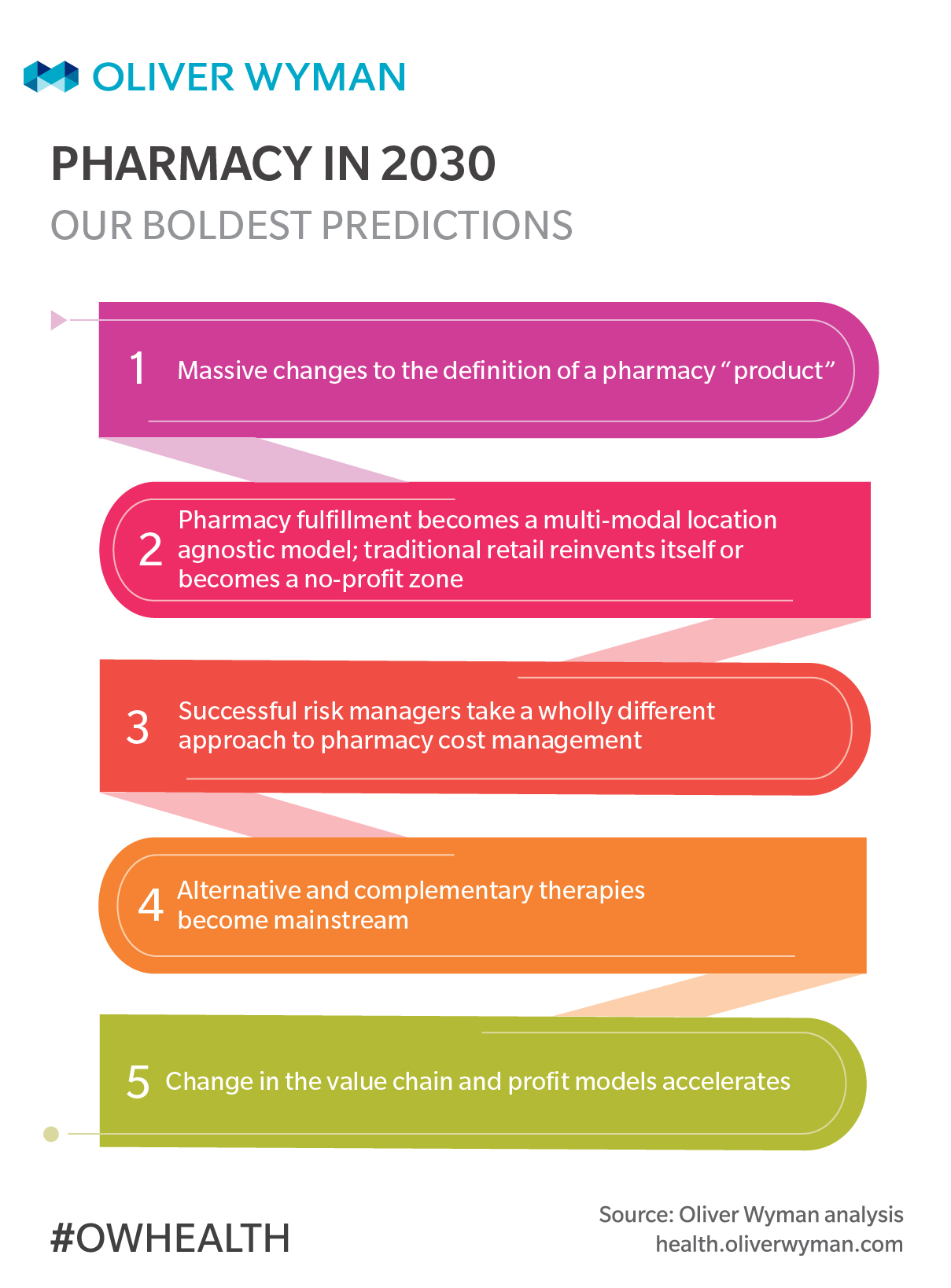

Oliver Wyman predicted four possible economic scenarios for healthcare 2030. Oliver Wyman and National Business Group on Health polled attendees at the Business Health Agenda 2019 event to see which of these four predictions employers, innovators, incumbents, and others think is most likely to come true. We hope this data provides insight into how the greater healthcare industry thinks big change will happen next and who may be most likely to win (and lose) profit share over the next decade.

Healthcare 2030: Four Economic Scenarios

There are a few claims we’re making (with confidence!) about healthcare’s future. We predict healthcare’s migration to value will continue. Margin pressure and intense competitive pressure will push efficiency among incumbents (like automating and transitioning care to lower acuity environments). Industry boundaries will be challenged as digital, retail, and other companies make deeper forays into healthcare. But how fast will change happen? And who will win (and lose) profit share?

Indonesia 2030: The $68 Billion Healthcare Opportunity

Indonesia is one of the world’s great economic successes. It is already the 16th-largest economy in the world, with the third highest growth rate in the G20. At the current trajectory it will be one of the five biggest economies in the world by 2030.

As Indonesia designs a blueprint for a healthcare ecosystem for the new era, it will need to manage the triple aims of high quality, low cost, and greater patient access. As it does this, we see five areas of particular priority. These are both the most important developments and the areas of greatest opportunity for private-sector players. Find the five key imperatives to achieve the 2030 Indonesian Healthcare vision via our interactive graphic.

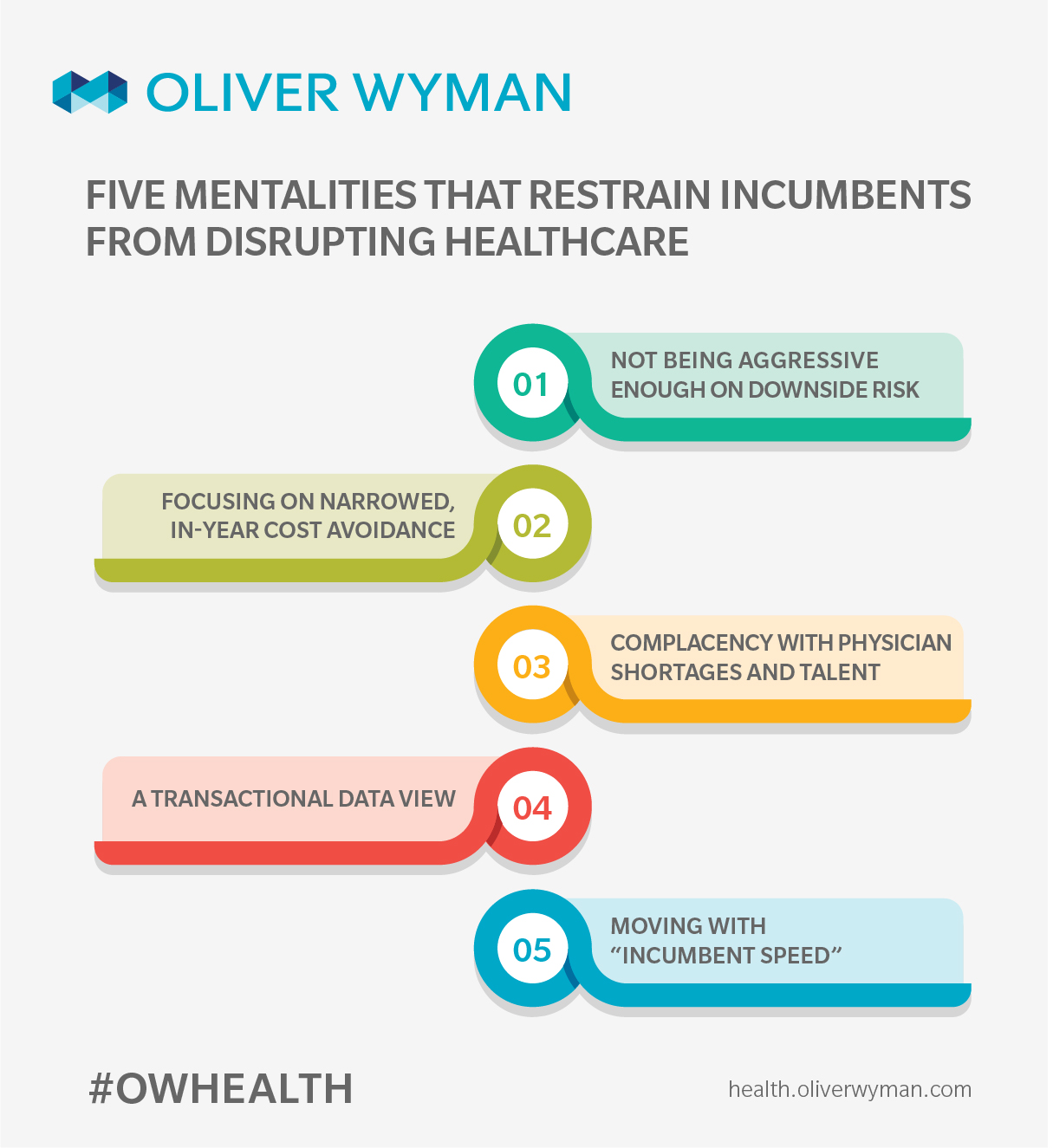

Healthcare in 2030: Five Mindsets Holding Incumbents Back

The healthcare industry’s progress solving major issues – cost, outcomes, experience – can perhaps best be described as incremental. Medical cost still outpaces inflation, increasing pressure to cut costs. The value chain remains static, as payers continue to own the bulk of lives, and provider-owned health plans are niched. Sure, value-based care adoption presses onward – led by the Centers for Medicare and Medicaid Services (CMS) – but most adoption efforts, focused on healthy or at-risk consumers, are still reimbursed via fee-for-service (FFS) payment models. Despite some notable progress, healthcare continues to lag most other industries in its inability to engage consumers, thereby putting other industries at the forefront of innovation.

Perhaps it all comes down to changing the incumbent mindset. Here are five mentalities that hold incumbents back from disrupting healthcare, where had the industry moved more quickly or flipped the script with a bit more strategic design, healthcare’s disruption would be more likely to come from inside, not outside.